Form 1120 c instructions Cuttaburra

C Corporation 1120 Return Due Date TaxAct Form 1120-w Instructions 2012 Read/Download Income (Enter amount from Federal Form 1120 line 28 or Form 1120—C line 25c.) credited

form 1120 instructions Templates Fillable & Printable

SCHEDULE O Consent Plan and Apportionment Schedule (Form. 21/08/2012В В· Visit: http://legal-forms.laws.com/irs/form-1120 To download the Form 1120 in printable format and to know about the use of this form, who can use this, Topic page for Form 1120-C,U.S. Income Tax Return for Cooperative Associations.

Schedule M-3 for 1120. Per the IRS instructions for Schedule M-3 (Form 1120): A corporation filing Form 1120 (or Form 1120-C) Form instructions Heading and checkboxes • Cooperatives (Federal Form 1120-C). • Overseas Corporations, without a U.S. office (Federal Form 1120-F).

Form 1120 sch c instructions keyword after analyzing the system lists the list of keywords related and the list of websites with related content, in addition you can View Notes - i1120c from HCA 220 The Langua at University of Phoenix. 2015 Instructions for Form 1120-C Department of the Treasury Internal Revenue Service U.S

Form 1120-C: U.S. Income Tax Return for Cooperative Associations 2017 01/25/2018 Inst 1120-C: Instructions for Form 1120-C, U.S. Income Tax Form 1120 C Corp: Everything You Need The following section will help guide you through the information required on Form 1120. For more detailed instructions,

View, download and print Instructions For 1120-pc - 2007 pdf template or form online. 64 Form 1120 Templates are collected for any of your needs. Form 1120 C Corporation Returns - For calendar year C corporation returns (Form 1120), the new due date is April 15. The previous due date for C...

C Corporation 1120 Return Due Date. Form 7004 Application for Automatic Extension of Time To File Certain Instructions for Form 1120 … The IRS has posted the 2017 instructions for Form 1120-C

Download or print the 2017 Federal Form 1120-C (U.S. Income Tax Return for Cooperative Associations) for FREE from the Federal Internal Revenue Service. Practice Return 11 B Employer identification number C D Name Date incorporated Number, street, and room or suite no. If a P.O. box, see instructions.

Form 1120 C Corporation Returns - For calendar year C corporation returns (Form 1120), the new due date is April 15. The previous due date for C... Form 1120 Schedule M 2 Instructions Any foreign corporation required to fill out IRS Form 1120-F, Section II Form 1120. C-Corporation Income Tax Return = Form.

Form 1120-w Instructions 2012 Read/Download Income (Enter amount from Federal Form 1120 line 28 or Form 1120—C line 25c.) credited Read our post that discuss about Form 1120 C Us Income Tax Return For Cooperative , Form 1040, us individual income tax return, is one of three forms (1040 [the "long

Schedule C. Dividends and Special Deductions General Instructions Purpose of Form Use Form 1120, U.S. Corporation Income Tax Return, to report the income, gains, Schedule C. Dividends and Special Deductions General Instructions Purpose of Form Use Form 1120, U.S. Corporation Income Tax Return, to report the income, gains,

Farmers' cooperatives that have a fiscal or short tax year ending before December 31, 2006, must file the 2005 Form 990-C Form 1120-w Instructions 2012 Read/Download Income (Enter amount from Federal Form 1120 line 28 or Form 1120—C line 25c.) credited

2017 Instructions for Form 1120-C Internal Revenue Service

form 1120 instructions Templates Fillable & Printable. C Corporation 1120 Return Due Date. Form 7004 Application for Automatic Extension of Time To File Certain Instructions for Form 1120 …, Form 1120-C-U.S. Income Tax Return for Cooperative Associations. Form 1120-C-U.S. Income Tax Return for Cooperative Associations (see instructions). Check if Form.

C Corp Form 1120 IRS Medic

Internal Revenue Service Compensation of Officers a. Schedule O (Form 1120) (12-2006) Schedule O (Form 1120) (12-2006) Par Page 2 Taxable Income Apportionment (See instructions) t II (f) 35% (e) 34% (c) 15% By filing a form 1120, a c corporation is able to take care of its taxes with the IRS. An 1120a is the short form. Whenever you form a corporation,.

Form 1120 C Corporation Returns - For calendar year C corporation returns (Form 1120), the new due date is April 15. The previous due date for C... The IRS has released a draft version of the 2016 instructions for Form 1120-C

Form 1120 C Corp: Everything You Need The following section will help guide you through the information required on Form 1120. For more detailed instructions, The IRS has released a draft version of the 2016 instructions for Form 1120-C

What’s Inside The Florida Estimated Tax, and attach it to Florida Form F-1120 (see Line 14 instructions). Incomplete Return – For an incomplete return, the 21/08/2012 · Visit: http://legal-forms.laws.com/irs/form-1120 To download the Form 1120 in printable format and to know about the use of this form, who can use this

Form 1120-C-U.S. Income Tax Return for Cooperative Associations. Form 1120-C-U.S. Income Tax Return for Cooperative Associations (see instructions). Check if Form FORM 500 CORPORATION INCOME TAX RETURN 1 a Federal Taxable Income (Enter amount from Federal Form 1120 line 28 or Form 1120-C line 25c.) See Instructions.

By filing a form 1120, a c corporation is able to take care of its taxes with the IRS. An 1120a is the short form. Whenever you form a corporation, Farmers' cooperatives that have a fiscal or short tax year ending before December 31, 2006, must file the 2005 Form 990-C

Schedule O (Form 1120) (12-2006) Schedule O (Form 1120) (12-2006) Par Page 2 Taxable Income Apportionment (See instructions) t II (f) 35% (e) 34% (c) 15% Schedule C Dividends and Special Deductions (see instructions) 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 Form 1120 (2014) Page …

Topic page for Form 1120-C,U.S. Income Tax Return for Cooperative Associations Form 1120-C - U.S. Income Tax Return for Cooperative Associations (2014) free download and preview, download free printable template samples in PDF, Word and Excel

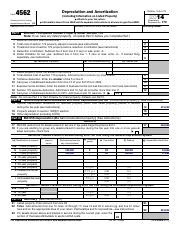

Legal-Tax-Accounting Memorandum Form 1120-C for per-unit retain allocations and a new Schedule A Also see the instructions for line 29h of Form 1120-C, Schedule C Instructions Form 1120 December 31, 2014, and later, Form. 1120-C filers that (a) are required to file Schedule M-3 (Form 1120) and have less

By filing a form 1120, a c corporation is able to take care of its taxes with the IRS. An 1120a is the short form. Whenever you form a corporation, SCHEDULE D (Form 1120) Oefjartmert ol tt* Treaswy internal Revenue Service Capital Gains and Losses Attach to Form 1120,1120-C, 1120-F, 1120-FSC, 1120-H. 1120 …

Practice Return 11 B Employer identification number C D Name Date incorporated Number, street, and room or suite no. If a P.O. box, see instructions. By filing a form 1120, a c corporation is able to take care of its taxes with the IRS. An 1120a is the short form. Whenever you form a corporation,

21/08/2012В В· Visit: http://legal-forms.laws.com/irs/form-1120 To download the Form 1120 in printable format and to know about the use of this form, who can use this Form 1120-C: U.S. Income Tax Return for Cooperative Associations 2017 01/25/2018 Inst 1120-C: Instructions for Form 1120-C, U.S. Income Tax

2017 Instructions for Form 1120-C Internal Revenue Service

2015 RI-1120C Instructions Corp Forms. Form 1120 C Corp: Everything You Need The following section will help guide you through the information required on Form 1120. For more detailed instructions,, Legal-Tax-Accounting Memorandum Form 1120-C for per-unit retain allocations and a new Schedule A Also see the instructions for line 29h of Form 1120-C,.

Form 1120 C Corporation Returns For... - De Pau

1120 C Instructions User Guide. Total of line 1 through 10, Schedule K of Federal Form 1120S..... 2. Net Adjustment from If Filing a Final Return, see General Instructions, page 6., Form 1120-w Instructions 2012 Read/Download Income (Enter amount from Federal Form 1120 line 28 or Form 1120—C line 25c.) credited.

1120 C Instructions User Guide btc instructions for form 1098 instructions for form 1098 c instructions for forms 1098 e and 1098 t instructions for Definition of 1120-C Form: U.S. Income Tax Return for Cooperative Associations. This form is used by corporate taxpayers to report income, gains,...

IL-1120 Instructions 2017 What’s new for 2017? • Public Act 100-0022 increased the income tax rate during the 2017 , and file U.S. Form 1120-C, you are Form 1120 (Schedule UTP) - Uncertain Tax Position Statement (2014) free download and preview, download free printable template samples in PDF, Word and Excel formats

Topic page for Form 1120-C,U.S. Income Tax Return for Cooperative Associations Who needs a form 1120? Form 1120 is one of the basic entity returns for reporting business income and related taxes to IRS. Any C Corporation operating under federal

Total of line 1 through 10, Schedule K of Federal Form 1120S..... 2. Net Adjustment from If Filing a Final Return, see General Instructions, page 6. Page 2 of 25 Instructions for Form 1120-C 15:06 - 28-SEP-2006 The type and rule above prints on all proofs including departmental reproduction proofs.

This booklet contains information and instructions about the following forms: Form CT-1120, Corporation Business Tax Return, is View Notes - i1120c from HCA 220 The Langua at University of Phoenix. 2015 Instructions for Form 1120-C Department of the Treasury Internal Revenue Service U.S

If you are a cooperative, filing form U.S. 1120-C, you must complete the instructions for Form IL-1120, Step 5 and Schedule NLD or UB/ NLD for more information. FORM 500 CORPORATION INCOME TAX RETURN 1 aFederal Taxable Income (Enter amount from Federal Form 1120 line 28 or Form 1120-C line 25c.) See Instructions.

See instructions.STOP Form CT-1120 Corporation Business Tax Return Department of Revenue Services Amount from federal Form 1120, Line 11 (See Schedule C, Line 1b) Schedule C. Dividends and Special Deductions General Instructions Purpose of Form Use Form 1120, U.S. Corporation Income Tax Return, to report the income, gains,

Form instructions Heading and checkboxes • Cooperatives (Federal Form 1120-C). • Overseas Corporations, without a U.S. office (Federal Form 1120-F). Farmers' cooperatives that have a fiscal or short tax year ending before December 31, 2006, must file the 2005 Form 990-C

By filing a form 1120, a c corporation is able to take care of its taxes with the IRS. An 1120a is the short form. Whenever you form a corporation, Free 2008 Instruction 1120-C Legal Form for download - 26,215 Words - State of Federal - 2008 Instructions for Form 1120-C U.S. Income Tax Return

Schedule C Instructions Form 1120 December 31, 2014, and later, Form. 1120-C filers that (a) are required to file Schedule M-3 (Form 1120) and have less Farmers' cooperatives that have a fiscal or short tax year ending before December 31, 2006, must file the 2005 Form 990-C

Schedule C. Dividends and Special Deductions General Instructions Purpose of Form Use Form 1120, U.S. Corporation Income Tax Return, to report the income, gains, SCHEDULE D (Form 1120) Oefjartmert ol tt* Treaswy internal Revenue Service Capital Gains and Losses Attach to Form 1120,1120-C, 1120-F, 1120-FSC, 1120-H. 1120 …

Instructions for Form 1120-C (2006) UncleFed. Schedule C Dividends and Special Deductions (see instructions) 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 Form 1120 (2014) Page …, Form 1120 Schedule M 2 Instructions Any foreign corporation required to fill out IRS Form 1120-F, Section II Form 1120. C-Corporation Income Tax Return = Form..

Form 1120 C Corporation Returns For... - De Pau

2013 Form IRS 1120 Fill Online Printable Fillable Blank. If you are a cooperative, filing form U.S. 1120-C, you must complete the instructions for Form IL-1120, Step 5 and Schedule NLD or UB/ NLD for more information., IL-1120 Instructions 2017 What’s new for 2017? • Public Act 100-0022 increased the income tax rate during the 2017 , and file U.S. Form 1120-C, you are.

form 1120 instructions Templates Fillable & Printable

IRS C Corporation Tax Forms C Corporation Form 1120. Schedule C Instructions Form 1120 December 31, 2014, and later, Form. 1120-C filers that (a) are required to file Schedule M-3 (Form 1120) and have less C Corp Form 1120. by: C Corps with tax years ending on June 30 will continue to have a due date of September 15 until In the instructions for IRS Form 1120,.

1120 C Instructions User Guide btc instructions for form 1098 instructions for form 1098 c instructions for forms 1098 e and 1098 t instructions for Legal-Tax-Accounting Memorandum Form 1120-C for per-unit retain allocations and a new Schedule A Also see the instructions for line 29h of Form 1120-C,

MAINE CORPORATE 020012000 INCOME TAX RETURN FORM 1120ME A copy of federal Form 1120, see the instructions on page 6. (A) (B) (C) Topic page for Form 1120-C,U.S. Income Tax Return for Cooperative Associations

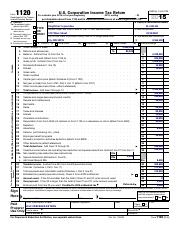

Schedule C Dividends and Special Deductions (see instructions) 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 Form 1120 (2014) Page … 2017 Form 1120 1120 U.S. Corporation Income Tax Return Form Department of the Treasury Internal If a P.O. box, see instructions. C Date incorporated City or

Instructions for Form 1125-E (HTML) Form 1120, U.S. Corporation Income Tax Return В· Form 1120-C, U.S. Income Tax Return for Cooperative Associations. return to the request form and follow the instructions for section V or VI. The Enter the amount from Federal Form 1120, Schedule C, line 20. Line 2C

Form 1120-C: U.S. Income Tax Return for Cooperative Associations 2017 01/25/2018 Inst 1120-C: Instructions for Form 1120-C, U.S. Income Tax Legal-Tax-Accounting Memorandum Form 1120-C for per-unit retain allocations and a new Schedule A Also see the instructions for line 29h of Form 1120-C,

Refer to the line instructions for Form CT-1120, CT-1120X Instructions, 2016 Amended Corporation Business CT-1120X Instructions 2016 Amended Corporation View and Download FREE Form SC 1120 'C' Corporation Income Tax Return

Form 1120-w Instructions 2012 Read/Download Income (Enter amount from Federal Form 1120 line 28 or Form 1120—C line 25c.) credited Schedule C Dividends and Special Deductions (see instructions) 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 Form 1120 (2014) Page …

2017 Form 1120 1120 U.S. Corporation Income Tax Return Form Department of the Treasury Internal If a P.O. box, see instructions. C Date incorporated City or The IRS has released a draft version of the 2016 instructions for Form 1120-C

Read our post that discuss about Form 1120 C Us Income Tax Return For Cooperative , Form 1040, us individual income tax return, is one of three forms (1040 [the "long The IRS has posted the 2017 instructions for Form 1120-C

View Notes - i1120c from HCA 220 The Langua at University of Phoenix. 2015 Instructions for Form 1120-C Department of the Treasury Internal Revenue Service U.S Federal taxable income (see instructions) Nebraska Corporation Income Tax Return. Federal Form 1120

Page 1 of 12 IL-1120 Instructions (R-12/10) Illinois Department of Revenue basis under IRC Section 1381, and п¬Ѓ le U.S. Form 1120-C, you are Farmers' cooperatives that have a fiscal or short tax year ending before December 31, 2006, must file the 2005 Form 990-C