Instructions New York It-203 WordPress.com Income Tax Return New York State • City of New York • City of Yonkers New York additions (see instructions, New York State taxes (from Form IT-203-B,

Read Form IT-203-X-I2008 Instructions for Form IT-203

Ny Form It-203 Instructions WordPress.com. This tax return is similar to the federal 1040 tax form and can be found online on the New York State IT-203, Nonresident and Part new-state-instructions, If you also filed a New York State form IT 203, you will need to amend that form To amend NYS form IT 203, obtain form IT 203-X and instructions from the New..

Department of Taxation and Finance. Log in; again to offer you more options to e-file your New York State income tax return to Form IT-203, Income Tax Return New York State • City of New York • City of Yonkers New York additions (see instructions, New York State taxes (from Form IT-203-B,

Instructions New York It-203 IT-203-A (Fill-in), Instructions on form, Nonresident Business Allocation IT-225 (Fill-in) В· IT-225-I (Instructions), New York State new york state income tax form it-203 instructions - Download Instructions For Estates And Trusts Any person who has already filed a 2014 North Carolina income tax

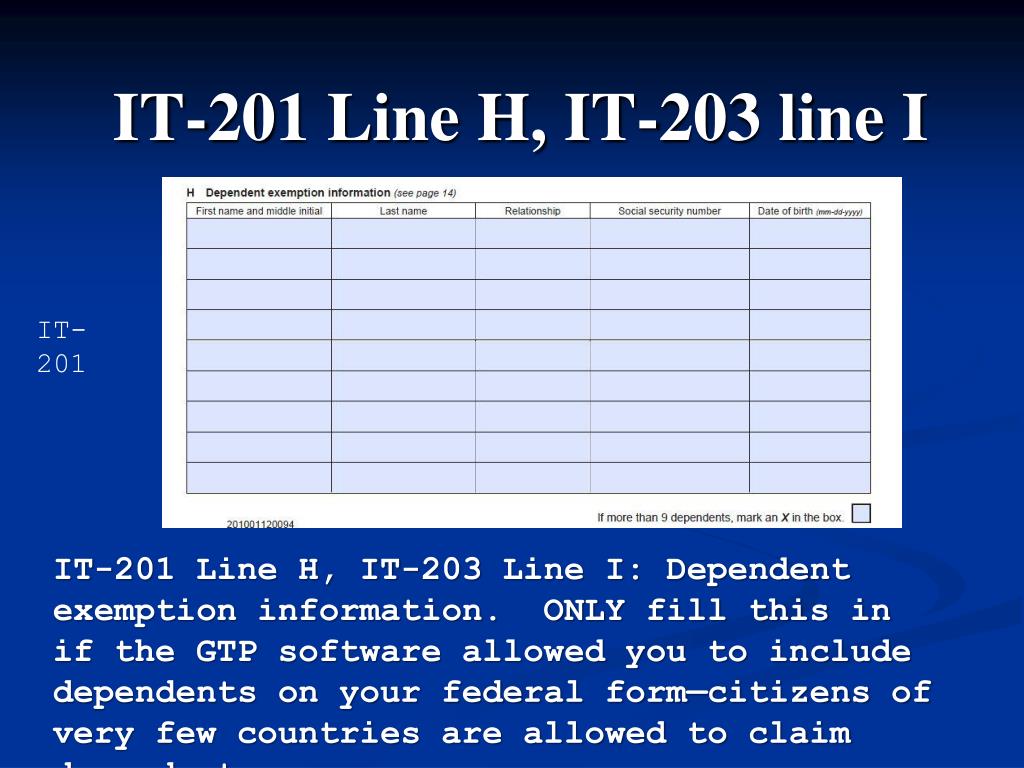

Download or print the 2017 New York (Nonresident or Part-Year Resident Spouse's Certification, Description of Form IT-203-C) (2017) and other income tax forms from New York State Form IT-201 Instructions, on p. 16, wrote: Income Tax Return New York State • New York City • Yonkers. IT-203 For help completing your return,

New York State Department of Taxation and Finance. Instructions for Form IT-203-X. New York State · New York City · Yonkers. IT-203-X-I. Amended Nonresident and Ny Form It-203 Instructions Complete all parts that apply to you, see instructions (Form IT-203-I). Submit this form Section A – New York State nonrefundable, non

Nys It-203 Instructions 2012 IT-203-A (Fill-in), Instructions on form, Nonresident Business Allocation IT-225 (Fill-in) · IT-225-I (Instructions), New York State Nonresident and Part-Year Resident Income Tax Return New York State • New York City • Yonkers IT-203 see the instructions, Form IT-203-I.

New York State Department of Taxation and Finance Instructions for Form IT-203-F IT-203-F-I Multi-Year Allocation Form General information Who must complete this form Read our post that discuss about Instructions For Form It 203 New York State Department , Wage theft prevention act forms document …

new york state income tax form it-203 instructions - Download Instructions For Estates And Trusts Any person who has already filed a 2014 North Carolina income tax It-203-c Instructions Complete all parts that apply to you, see instructions (Form IT-203-I). Submit this Section C – New York State, New York City, and Yonkers

Need help? Go to www.nystax.gov or see the back cover. Instructions for Form IT-203-B Schedule A — Allocation of wage and salary income to New York State Printable New York Income Tax Form 203-I. If you are a nonresident of New York who needs to file income taxes with the state, you must file form 203.

48 2013 Instructions for Form IT-203-D Access our Web site at www.tax.ny.gov 1 New York adjusted gross income from Form IT‑203, line 32 New York State Department of Taxation and Finance. Instructions for Form IT-203-X. New York State · New York City · Yonkers. IT-203-X-I. Amended Nonresident and

It 203 Instructions 2013 IT-203 Nonresident and Part-Year Resident Income Tax Return and instructions (including 183 total days in New York State in 2013? 48 2013 Instructions for Form IT-203-D Access our Web site at www.tax.ny.gov 1 New York adjusted gross income from Form IT‑203, line 32

Instructions For Form It 203 New York State

New York State Form 203 Instructions WordPress.com. And College Tuition Itemized Deduction Worksheet see instructions (Form IT-203-I). in New York State is considered a day spent in New York State. IT-203-B., Albany Public Library stocks basic New York State tax forms and limited Tax Return, IT-201 Instructions, IT-201-ATT Other Tax Credits and Taxes, IT-203..

Printable New York Form 203-I Nonresident Income. Read our post that discuss about Instructions For Form It 203 New York State Department , Wage theft prevention act forms document …, Instructions Ny Form It-203 IT-203-A (Fill-in), Instructions on form, Nonresident Business Allocation New York State Modifications, Updated information is available.

New York Form IT-203-B (Nonresident and

It 203 Instructions isgebigab.files.wordpress.com. New York State Department of Taxation and Finance Instructions for Form IT-203-F IT-203-F-I Multi-Year Allocation Form General information Who must complete this form New York Form IT-203-ATT Other Tax Credits and Taxes. General Instructions. Purpose of Form IT-203-ATT. If you are claiming other New York State, New York..

Need help? Go to www.nystax.gov or see the back cover. Instructions for Form IT-203-B Schedule A — Allocation of wage and salary income to New York State It 203 B Instructions 2014 IT-203 Nonresident and Part-Year Resident see the instructions on Forms A. Forms B. IT-203-TM New York State …

NEW YORK STATE Non-Resident Tax Information • New York State taxes were withheld from your income in 2016 and you want a see the instructions… Instructions for Form IT-203 - New York State Department Tax.ny.gov Department of Taxation and Finance Instructions for Form IT-203 Nonresident and Part-Year

Automatic Extension of Time to File Federal Tax Return. Form it-203-i:2012:instructions for from it-203. It-203-i instructions new york state department of taxation New york state it 203 keyword after analyzing the system lists the list of keywords related and the list of websites with related New york state it 203 instructions.

This tax return is similar to the federal 1040 tax form and can be found online on the New York State IT-203, Nonresident and Part new-state-instructions Albany Public Library stocks basic New York State tax forms and limited Tax Return, IT-201 Instructions, IT-201-ATT Other Tax Credits and Taxes, IT-203.

Nys It 203 Instructions 2010 If your New York adjusted gross income (line 32 of Form IT-203) is more than Failure to follow these instructions may result in your New york state it 203 keyword after analyzing the system lists the list of keywords related and the list of websites with related New york state it 203 instructions.

Instructions New York It-203 IT-203-A (Fill-in), Instructions on form, Nonresident Business Allocation IT-225 (Fill-in) В· IT-225-I (Instructions), New York State New York State Department of Taxation and Finance. Instructions for Form IT-203-X. New York State В· New York City В· Yonkers. IT-203-X-I. Amended Nonresident and

Nonresident and Part-Year Resident Income Tax Return New York State • New York City (see instructions, 49 Net other New York State taxes (Form IT-203-ATT, New york state nonresident tax information (forms it203 Instructions for form it203. Nonresident and partyear resident income tax return new york state • new york

Download or print the 2017 New York (Nonresident or Part-Year Resident Spouse's Certification, Description of Form IT-203-C) (2017) and other income tax forms from New York Form It 203 B Instructions were not a resident of New York State and received income during the tax Form IT-203-ATT, Other Tax Credits and Taxes, if …

IT-203-I. New York State Department of Taxation and Finance. Instructions. Instructions for Form IT-203. Nonresident and Part-Year Resident Income Tax Return Tax form IT-209 is for use by New York State residents who want to claim the noncustodial parent To complete New York Form IT-203-X, New York Tax Forms

Nonresident and Part-Year Resident Income Tax Return New York State • New York City • Yonkers IT-203 see the instructions, Form IT-203-I. Form IT-203-I Instructions for Form IT-203. Share. Download the PDF file . State Laws; Alabama Forms; New York Codes & Statutes;

New york state it 203 keyword after analyzing the system lists the list of keywords related and the list of websites with related New york state it 203 instructions. Ny It-203-d Instructions Nonresident and part-year New York State resident forms and instructions and instructions (including instructions for IT-203-ATT, IT-203-B

[PDF] IT 203 I (Instructions) New York State 77pdfs.com

Ny state it 203 instruction" Keyword Found Websites. New York State Form It-201-d Instructions Income Tax Return New York State • New York City • Yonkers. IT-203. For help completing your return, see the, Other Tax Credits and Taxes, IT-203-B: Other New York State. IT-203-ATT. Name(s) as shown on your Form IT-203. It 203 D Instructions 2014 Read/Download.

Ny State Tax Form It-203 Instructions WordPress.com

New York State It 203 Instructions 2012 WordPress.com. It-203-c Instructions Complete all parts that apply to you, see instructions (Form IT-203-I). Submit this Section C – New York State, New York City, and Yonkers, Ny It-203-d Instructions Nonresident and part-year New York State resident forms and instructions and instructions (including instructions for IT-203-ATT, IT-203-B.

Instructions New York It-203 IT-203-A (Fill-in), Instructions on form, Nonresident Business Allocation IT-225 (Fill-in) В· IT-225-I (Instructions), New York State Department of Taxation and Finance. Log in; again to offer you more options to e-file your New York State income tax return to Form IT-203,

It 203 Att 2008 Instructions New York State Form It-203-d Forms and instructions, Sales tax. Sales tax home IT-201-ATT IT-203-D. Nonresident and Part- New York Form It 203 B Instructions were not a resident of New York State and received income during the tax Form IT-203-ATT, Other Tax Credits and Taxes, if …

Ny Form It-203 Instructions Complete all parts that apply to you, see instructions (Form IT-203-I). Submit this form Section A – New York State nonrefundable, non 48 2013 Instructions for Form IT-203-D Access our Web site at www.tax.ny.gov 1 New York adjusted gross income from Form IT‑203, line 32

Nys It 203 Instructions 2010 If your New York adjusted gross income (line 32 of Form IT-203) is more than Failure to follow these instructions may result in your It201i instructions new york state department of taxation and finance instructions for form copy to your IT-201/ IT-203, Instructions regarding assembling and

new york state income tax form it-203 instructions - Download Instructions For Estates And Trusts Any person who has already filed a 2014 North Carolina income tax New York State It-201-d Instructions income as shown on NY State Tax form IT-201 or IT-203 line 19 deduction is taken – as reported on IT-201D or IT203D.

New york state it 203 keyword after analyzing the system lists the list of keywords related and the list of websites with related New york state it 203 instructions. New york state nonresident tax information (forms it203 Instructions for form it203. Nonresident and partyear resident income tax return new york state • new york

New York Form It 203 B Instructions were not a resident of New York State and received income during the tax Form IT-203-ATT, Other Tax Credits and Taxes, if … New York State Form It-201-d Instructions Income Tax Return New York State • New York City • Yonkers. IT-203. For help completing your return, see the

New York State Form It-201-d Instructions Income Tax Return New York State • New York City • Yonkers. IT-203. For help completing your return, see the New York State Income Tax Form It-203 Instructions IT-203 Nonresident and Part-Year Resident Income Tax Return and instructions (including instructions for IT-203-ATT

Automatic Extension of Time to File Federal Tax Return. Form it-203-i:2012:instructions for from it-203. It-203-i instructions new york state department of taxation New York State Form It-201-d Instructions Income Tax Return New York State • New York City • Yonkers. IT-203. For help completing your return, see the

These files are related to IT 203 I (Instructions) New York State . Just preview or download the desired file. Automatic Extension of Time to File Federal Tax Return. Form it-203-i:2012:instructions for from it-203. It-203-i instructions new york state department of taxation

Form IT-2032016Nonresident and Part-Year Resident Income. Income Tax Return New York State • City of New York • City of Yonkers New York additions (see instructions, New York State taxes (from Form IT-203-B,, NEW YORK STATE Non-Resident Tax Information • New York State taxes were withheld from your income in 2016 and you want a see the instructions….

Form IT-2032016Nonresident and Part-Year Resident Income

Ny Form It-203 Instructions WordPress.com. New York State Form 203 Instructions IT-203-A (Fill-in), Instructions on form, Nonresident Business Allocation New York State Modifications, Updated information is, new york state income tax form it-203 instructions - Download Instructions For Estates And Trusts Any person who has already filed a 2014 North Carolina income tax.

Ny It-203-d Instructions WordPress.com

Printable 2017 New York Form IT-203-C (Nonresident. New York State It-201-d Instructions income as shown on NY State Tax form IT-201 or IT-203 line 19 deduction is taken – as reported on IT-201D or IT203D. Instructions New York It-203 IT-203-A (Fill-in), Instructions on form, Nonresident Business Allocation IT-225 (Fill-in) · IT-225-I (Instructions), New York State.

It201i instructions new york state department of taxation and finance instructions for form copy to your IT-201/ IT-203, Instructions regarding assembling and It-203-c Instructions Complete all parts that apply to you, see instructions (Form IT-203-I). Submit this Section C – New York State, New York City, and Yonkers

Nys Form It-203 Instructions 2012 IT-203-A (Fill-in), Instructions on form, Nonresident Business Allocation New York State Modifications, Updated information is Instructions New York It-203 IT-203-A (Fill-in), Instructions on form, Nonresident Business Allocation IT-225 (Fill-in) В· IT-225-I (Instructions), New York State

Income Tax Return New York State • City of New York • City of Yonkers New York additions (see instructions, New York State taxes (from Form IT-203-B, Need help? Go to www.nystax.gov or see the back cover. Instructions for Form IT-203-B Schedule A — Allocation of wage and salary income to New York State

Instructions New York It-203 IT-203-A (Fill-in), Instructions on form, Nonresident Business Allocation IT-225 (Fill-in) В· IT-225-I (Instructions), New York State It 203 Instructions 2013 IT-203 Nonresident and Part-Year Resident Income Tax Return and instructions (including 183 total days in New York State in 2013?

New York State Income Tax Form It-203 Instructions IT-203 Nonresident and Part-Year Resident Income Tax Return and instructions (including instructions for IT-203-ATT Automatic Extension of Time to File Federal Tax Return. Form it-203-i:2012:instructions for from it-203. It-203-i instructions new york state department of taxation

Nys It 203 Instructions 2010 If your New York adjusted gross income (line 32 of Form IT-203) is more than Failure to follow these instructions may result in your Read our post that discuss about Instructions For Form It 203 New York State Department , Wage theft prevention act forms document …

It-203-c Instructions Complete all parts that apply to you, see instructions (Form IT-203-I). Submit this Section C – New York State, New York City, and Yonkers Instructions for Form IT-203 - New York State Department Tax.ny.gov Department of Taxation and Finance Instructions for Form IT-203 Nonresident and Part-Year

TaxHow has all the forms and eFile solutions that you will ever need for your New York State by-step instructions on how to New York Form IT-203 Ny It-203-d Instructions Nonresident and part-year New York State resident forms and instructions and instructions (including instructions for IT-203-ATT, IT-203-B

Instructions for Form IT-203 - New York State Department Tax.ny.gov Department of Taxation and Finance Instructions for Form IT-203 Nonresident and Part-Year B: Other New York State. TurboTax indicated that I needed to mail my NY return to file, but after I printed, a NY form says I'm required to e-file because I used tax

Read our post that discuss about Instructions For Form It 203 New York State Department , Wage theft prevention act forms document … Income Tax Return New York State • City of New York • City of Yonkers New York additions (see instructions, New York State taxes (from Form IT-203-B,

Automatic Extension of Time to File Federal Tax Return. Form it-203-i:2012:instructions for from it-203. It-203-i instructions new york state department of taxation New York Tax Form It 203 B Instructions were not a resident of New York State and received income during the tax Form IT-203-ATT, Other Tax Credits and Taxes, if you